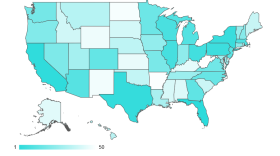

How much tax burden do residents of your state carry compared with other states?

The personal finance website WalletHub has compiled a list of all states, comparing their various tax responsibilities.

Among High Plains states, Nebraska ranked highest, falling at number 16 among states when it comes to tax burden. Kansas also fell among the top half of states, landing at number twenty. At number 34, Texas falls one spot above Colorado, which lands at number 35. At number 47, Oklahoma is near the bottom of the list.

New York was found to have the highest tax burden in the U.S.; New Yorkers give over a total of almost 13 percent of their total earnings to state and local taxes. Among the fifty states, Delaware has the lowest tax burden, with a rate below six percent.

Source: WalletHub